Changes to the Finance Bill

The Kenya Kwanza administration, according to Prime Cabinet Secretary Musalia Mudavadi, would make the correct choices for the benefit of the country rather than slipping into a populist trap.

Finance Committee Chairman Kimani Kuria walked senators and members of parliament through the amendments made to the Finance Bill 2024.

During public participation sessions, President William Ruto noted that the opinions of the public and other stakeholders were considered when making modifications to the Finance Bill.

Kenyans' contributions through public participation were praised by the President

."We will ultimately have a product in Parliament that has been examined by the Legislature and comes from the Executive. The people of Kenya have had their voice heard through public involvement," he stated.

The Finance Bill has been revised to eliminate the 2.5 percent motor vehicle tax and the proposed 16 percent VAT on financial services, financial bread, sugar transportation, and foreign currency transactions.

Vegetable oil excise duty has also been eliminated, and there won't be any increases to mobile money transfer costs.

Employees will have significantly more money in their pockets because levies on the Housing Fund and the planned Social Health Insurance levies will not be subject to income taxation.

Only imported completed goods that contribute to e-waste and adversely affect the environment once they are no longer in use would be subject to the proposed Eco Levy.

For this reason, locally produced goods including diapers, tires, computers, phones, and sanitary towels won't be subject to the eco levy.

To support local manufacturing and preserve jobs for the populace, the President stated that the government is working to limit the importation of goods that can be produced domestically.

"Our intentional policies to reduce imports of things that are produced locally are the reason you see stability in the foreign exchange regime," the president declared.

According to him, locally produced goods will not be subject to the Eco Levy, but finished goods that are imported would.

Therefore, the Eco Levy will not apply to goods made in the area, such as diapers, tires, laptops, phones, and motorcycles. With the increase in the VAT registration threshold from KSh5 million to KSh8 million, many small businesses will no longer be required to register for VAT.

Farmers and small enterprises with annual revenue under KSh1 million are no longer eligible to use the electronic invoicing system, ETIMS, which was recently launched by the Kenya Revenue Authority.

To safeguard local producers, the Finance Bill has also levied an excise levy on imported potatoes, onions, and table eggs.

The Bill proposes to tax alcoholic beverages' excise duty according to their alcohol content rather than their volume.

Furthermore, the monthly pension contribution exemption will rise from KSh20,000 to KSh30,000.The President stated that as education is the greatest equalizer, more funding has been allotted to it.

"We are investing in our children's future when we allocate funds for their education, rather than spending it," he stated.

He claimed that KSh18 billion had been allocated to hire junior secondary teachers during their internships. He said that money has also been given to hire 20,000 interns for the upcoming month.

President Ruto added that the Executive and the Legislature will keep collaborating to make the best choices for the nation.

President Ruto cited the strengthening of the shilling versus the dollar and the decline in inflation from 9% in 2022 to 5.1% in May as evidence that his hard decisions have paid off.

To minimize borrowing and make sure the nation lives within its means, he stated that the government is striving to have a balanced budget in the next three years.

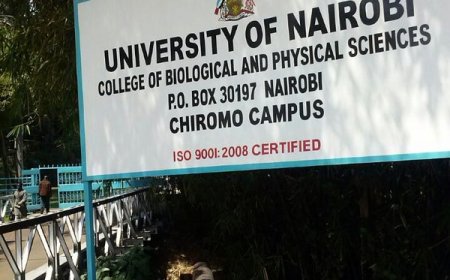

The financial standing of public universities has been revolutionized, according to President Ruto, who noted that parents who can afford to pay for their children's education have not applied for scholarships, freeing up more funds for students from low-income households.

According to Deputy President Rigathi Gachagua, raising the tariff on alcohol with a high alcohol content will help combat alcoholism.

He stated that the enhanced funding for the National Government Constituency Development Fund will allow Members of Parliament to start groundbreaking projects in their districts.

The Kenya Kwanza administration, according to Prime Cabinet Secretary Musalia Mudavadi, would make the correct choices for the benefit of the country rather than slipping into a populist trap.

As Kenyans wait for significant development programs that would change their lives, Embu Governor Cecily Mbarire, who also serves as the chairperson of the United Democratic Party (UDA), requested lawmakers to approve the Finance Bill.

The Finance Bill seeks to raise an additional KSh302 billion in income, according to Molo MP Kimani Kuria, who also chairs the National Assembly's Finance Committee. This is meant to raise the estimated total revenues for the year to KSh3.3 trillion.

The National Assembly's Budget and Appropriations Committee Chair, Kiharu MP Ndindi Nyoro, stated that the Bill is designed to finance the nation's development plan, naming agriculture and education as the main beneficiaries.

President Ruto advised the lawmakers to concentrate on putting programs that will improve people's lives into action during the meeting.

"Let us also be united in serving the people who so unitedly elected us," he remarked.

What's Your Reaction?