COMMERCIAL BANK OF ETHIOPIA `SYSTEM ERROR` LETS CUSTOMERS WITHDRAW MILLIONS

The largest commercial bank in Ethiopia is working frantically to recover significant amounts of money that clients withdrew due to a "systems glitch."

The largest commercial bank in Ethiopia is working frantically to recover significant amounts of money that clients withdrew due to a "systems glitch."

Early on Saturday, the clients of the Commercial Bank of Ethiopia (CBE) learned that they could withdraw more money than what was available in their accounts.

Local media said that around $40 million (£31 million) had been taken out or moved to other banks.

The institution waited several hours to halt the transactions.

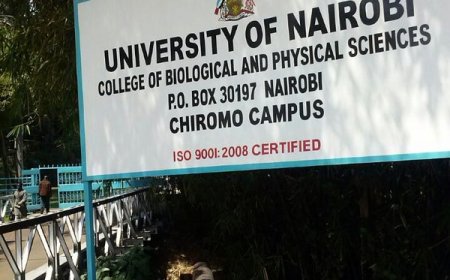

Journalists were informed on Monday by bank president Abe Sano that students had taken out a large portion of the funds from the state-owned CBE.

Phone calls and messaging apps were the main ways that word of the bug got throughout campuses.

A student in western Ethiopia told BBC Amharic that until police officials arrived on campus to stop them, individuals were withdrawing money from the ATMs on campus, causing long lineups to form.

The Jimma University Institute of Technology student claimed that when his classmates informed him at approximately 1:00 local time (22:00 GMT) that it was possible to withdraw substantial amounts from ATMs or transfer money using the bank's app, he "did not believe it was true."

At Dilla University in southern Ethiopia, another student reported that several of his classmates had taken money out of CBE between midnight and two in the morning local time.

CBE was founded 82 years ago and currently has over 38 million account holders.

The central bank of Ethiopia, which oversees the financial industry, said in a statement on Sunday that "a glitch" had happened during "maintenance and inspection activities."

On the other hand, the statement concentrated on the service interruption that followed CBE's decision to freeze all transactions. The money that customers withdrew was not mentioned.

Although Mr. Sano did not disclose the precise amount of money taken out during the incident on Saturday, he did state that the loss was minimal about the bank's overall holdings.

He said that CBE was not the target of a cyberattack and that clients didn't need to worry because their accounts were still active.

In statements made public, at least three colleges counsel students to return any money they may have received from CBE that does not belong to them.

According to Mr. Sano, there will be no criminal charges brought against anyone who returns money.

However, it's unclear how effective the bank's current efforts to recover its losses have been.

The Jimma University student claimed on Monday that he had seen police cars on campus but that he had not heard of anyone returning the money.

According to a Dilla University official, bank workers were on campus gathering money that some students were willingly returning.

What's Your Reaction?